Prioritizing Debt Repayment vs. Investment Opportunities: Find Your Confident Balance

Chosen theme: Prioritizing Debt Repayment vs. Investment Opportunities. Step into a clear, empowering approach to money where every payment and every contribution moves you forward. We’ll weigh interest rates, risks, emotions, stories, and strategies—so you can act with conviction today. Subscribe and join the conversation.

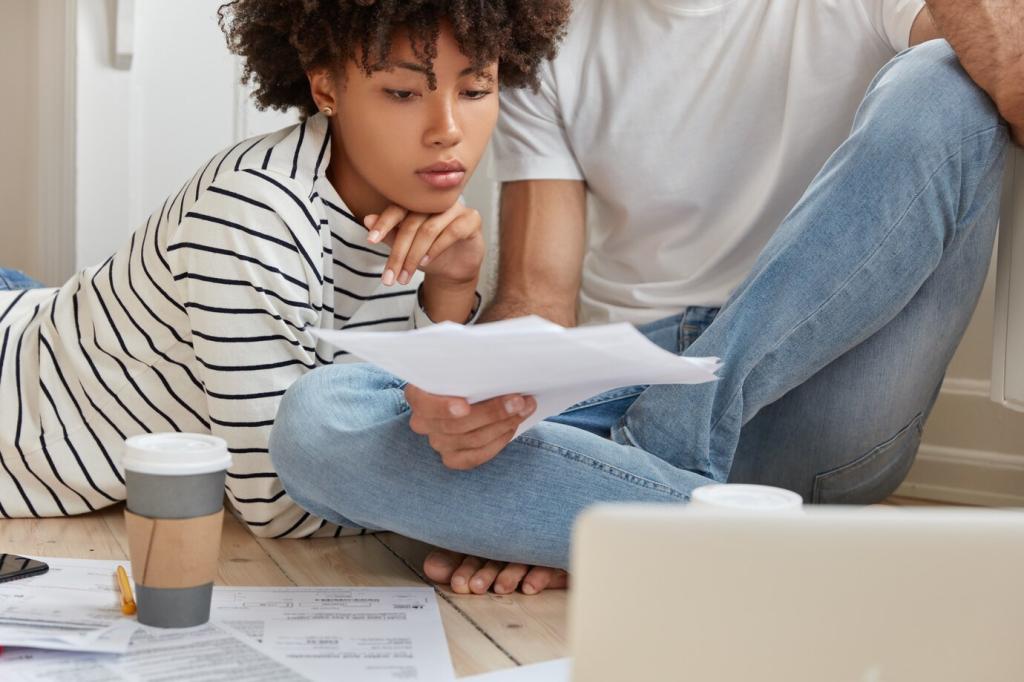

Behavioral Finance: Mindset, Motivation, and Momentum

Being debt-free offers emotional returns that spreadsheets can’t quantify. Lower anxiety can lead to better decisions and consistent investing later. Do you sleep better knocking out balances fast, or steadily funding your portfolio? Share what calms your mind most.

Behavioral Finance: Mindset, Motivation, and Momentum

Snowball builds motivation by paying smallest balances first; avalanche saves more by targeting highest rates. Many blend either method with automatic retirement contributions. Which approach fits your personality? Drop a comment—momentum or math-first, and how you’ll keep investing.

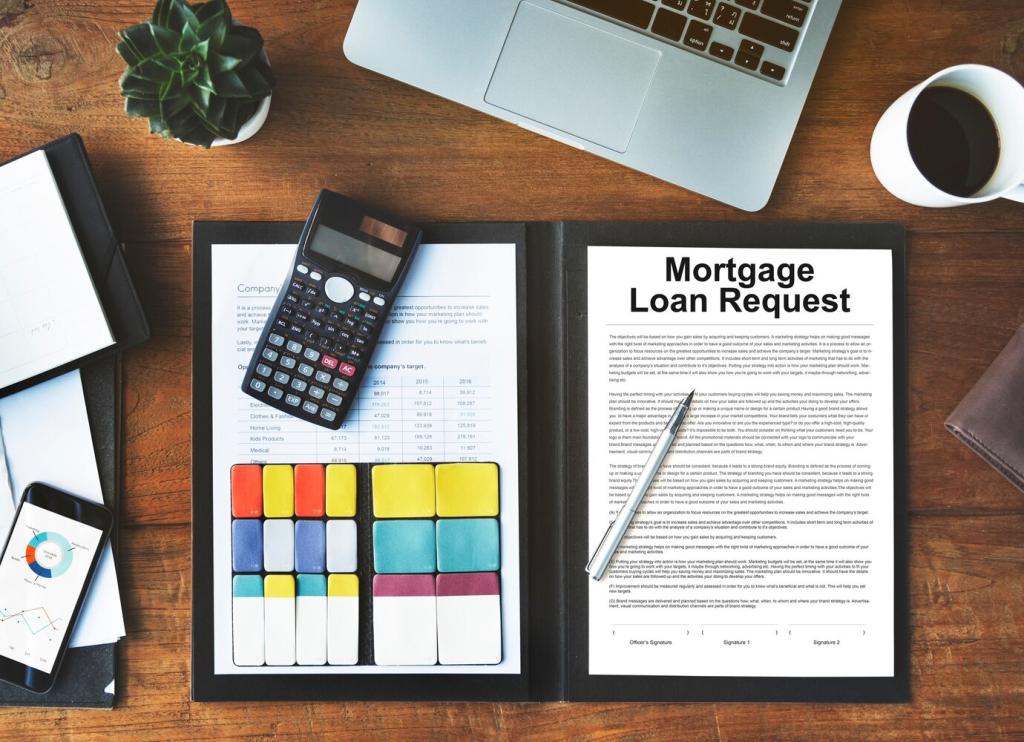

Practical Decision Rules for Clarity

The Interest-Rate Threshold Rule

Prioritize paying any debt above your realistic, after-tax expected market return. For many, that means anything over 7–8% gets fast-tracked. What’s your personal threshold? Post it publicly to keep yourself accountable this quarter.

Capture Free Money First

Employer matches (for example, 50% up to 6%) are a near-instant, risk-free return. Contribute enough to secure the full match, then funnel surplus toward high-interest balances. Do you have a match? Comment yes or no, and your percentage.

Liquidity Before Leverage

Build a starter emergency fund—often $1,000 to one month’s expenses—before aggressive payoff. This prevents new debt from emergencies. How many months of expenses would let you breathe easier? Declare your target and start a weekly transfer.

Real Stories: What Worked for Different Lives

The Recent Grad with 18% Credit Card Debt

A new grad diverted all extra cash to a punishing 18% card, but still contributed enough to get a modest employer match. Once the card hit zero, they ramped investing dramatically. Would this blended approach fit your current reality? Share your thoughts.

Taxes, Accounts, and Hidden Levers

Traditional and Roth accounts can magnify long-term gains through tax advantages. Capturing a match and tax-deferred growth can outweigh moderate-rate debt repayment. Which accounts do you use today, and what tax edge do they give you? Share your setup.

Risk Management: Protecting Your Plan From Setbacks

An emergency fund and essential insurance prevent one mishap from undoing progress. Without these, you risk new debt just when markets dip. What coverage or cash buffer do you need to sleep well? Declare your next protective step below.