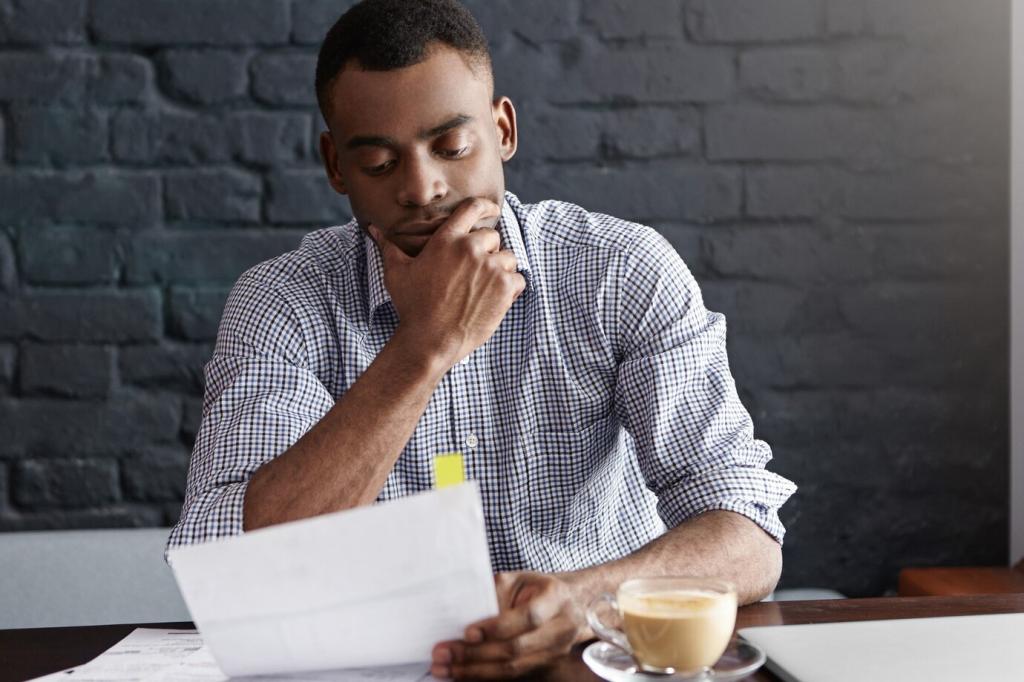

Side Income That Accelerates the Payoff

Combine what you do well—writing plus analytics, design plus marketing—to command better rates. Every $200 gig can become an extra principal payment while still funding a small investment. Share your best skill stack; others might need it.

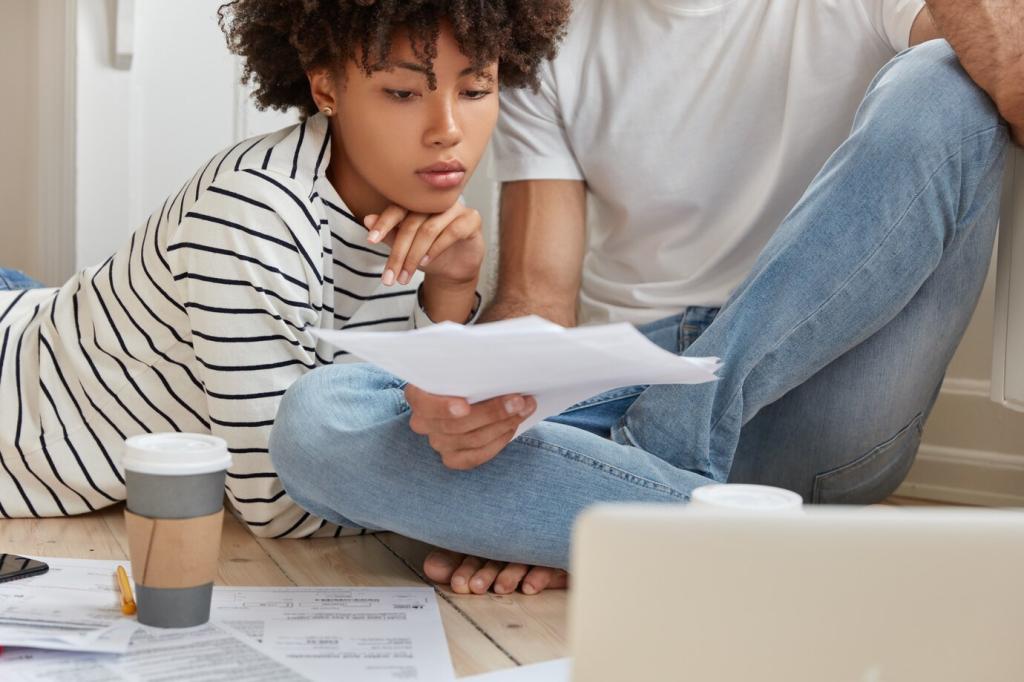

Side Income That Accelerates the Payoff

Test one idea per weekend: tutoring, product photography, no-code landing pages, virtual assistance. Track hours, payout, and joy. Keep winners, cut duds. These micro-tests speed building wealth while paying off debt without risking your primary income.