Navigating Financial Goals: Debt Clearance and Investment Growth

Chosen theme: Navigating Financial Goals: Debt Clearance and Investment Growth. Welcome to a practical, encouraging space where we chart a clear course to eliminate debt strategically while planting investments that compound steadily toward your biggest life goals.

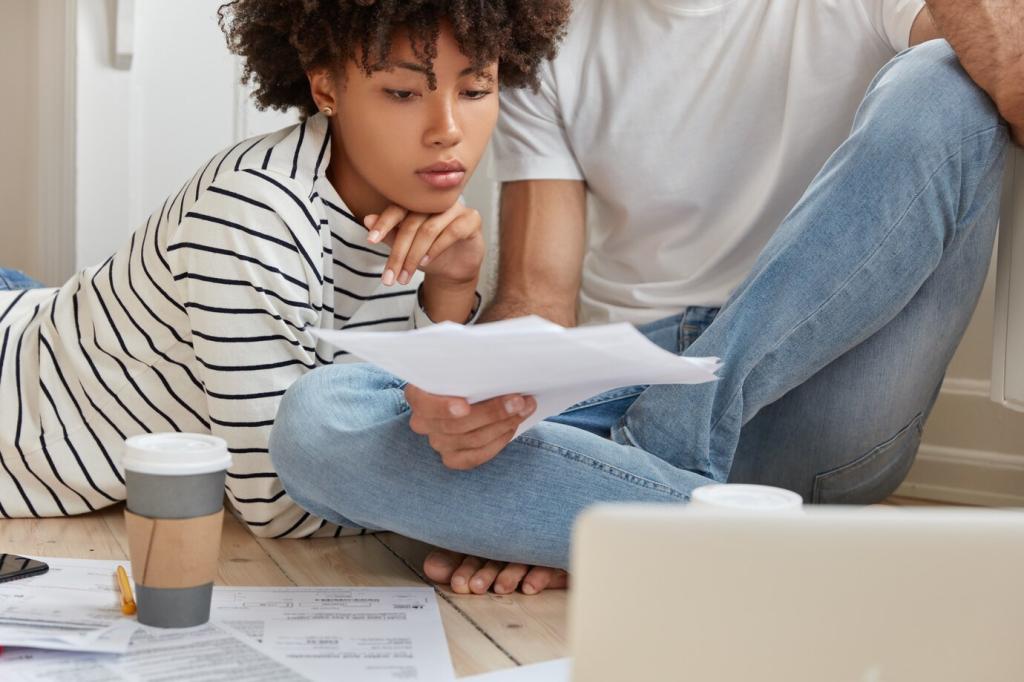

Setting a Clear Map for Your Money

Pick one compelling objective—like becoming debt-free by a specific date while building a starter investment portfolio. Give it a reason, a number, and a deadline, so decisions align with both freedom and growth.

Setting a Clear Map for Your Money

Create a timeline that anticipates seasonal costs, irregular income, and life’s surprises. When timelines flex, your plan survives detours, sustaining steady debt clearance while preserving consistent contributions to your investment accounts.

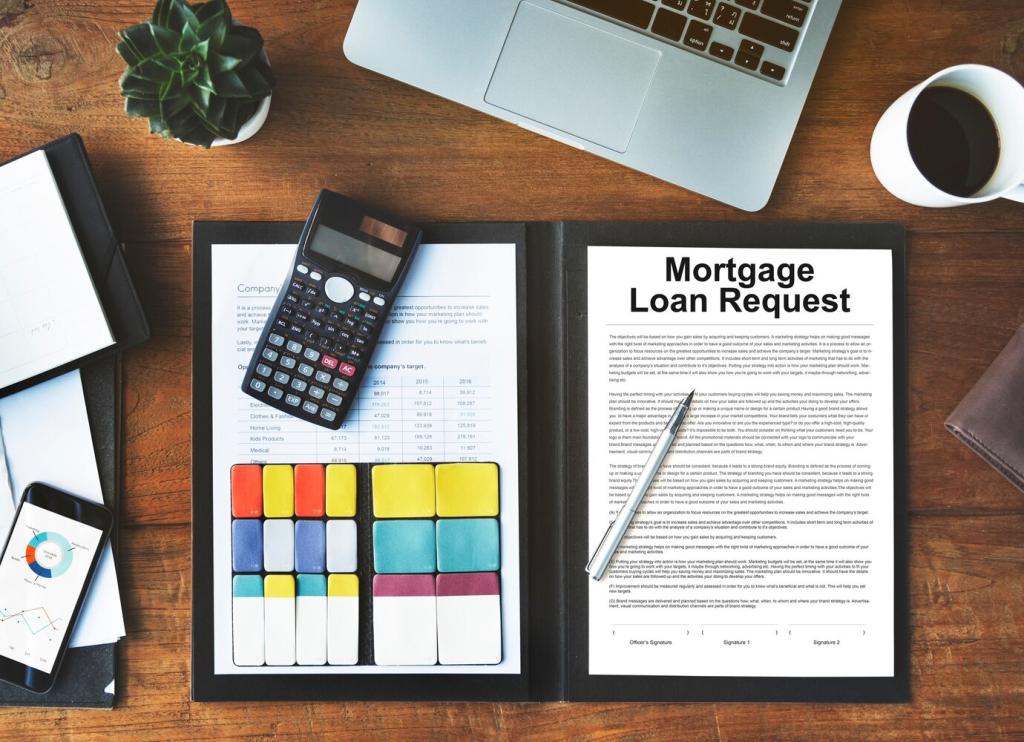

Smart Strategies for Clearing Debt

Avalanche vs. Snowball, Explained with Real Lives

The avalanche method attacks highest interest first for maximum math efficiency, while the snowball targets smallest balances to build quick wins. When Lisa switched to snowball, early victories boosted motivation, accelerating payments beyond her original projections.

Negotiation and Interest Rate Reductions

Call lenders to request lower rates, hardship options, or temporary reductions; a five-minute conversation can save months. Refinance cautiously, comparing total costs and timelines. Every percentage point shaved today advances tomorrow’s investment growth potential substantially.

Start Simple: Broad Market Funds and Automation

Automate recurring contributions into diversified, low-cost index funds. Simplicity reduces decision fatigue and trading mistakes, freeing energy to focus on debt clearance while your investments steadily accumulate shares through every market season and mood swing.

The Rule of 72 and Realistic Expectations

Use the Rule of 72 to estimate doubling time: divide 72 by your expected return. A 7% return doubles in roughly ten years, encouraging patience while you balance deliberate debt payoff with steady, disciplined investment growth.

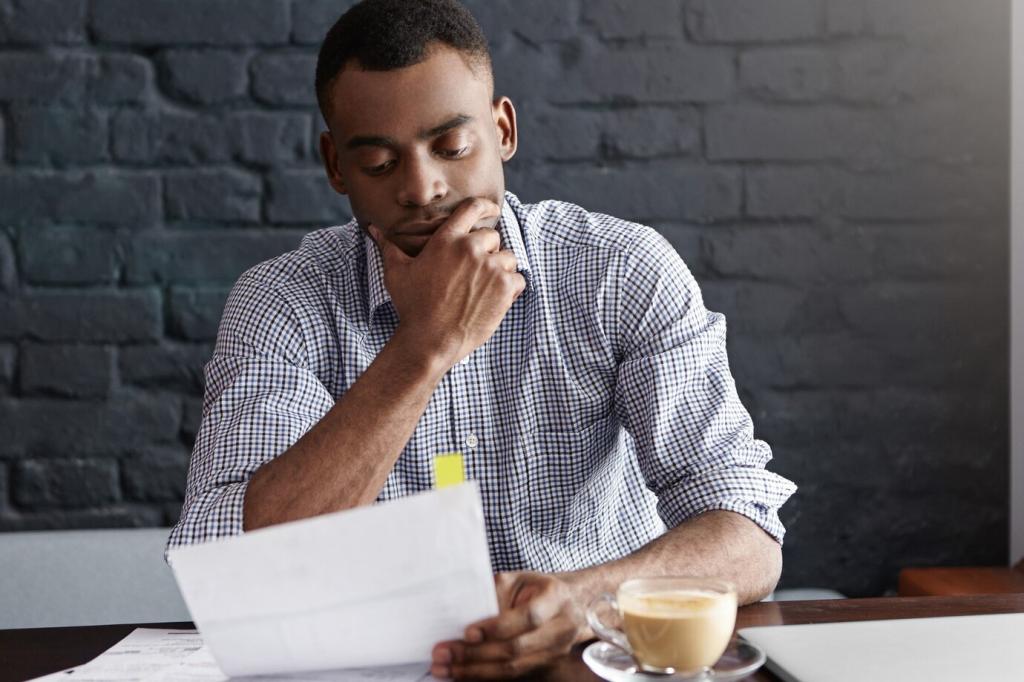

Balancing Debt Paydown and Investing Simultaneously

Compare your after-tax loan interest rate with expected long-term returns. If debt costs more, prioritize payoff; if lower, split funds. Always maintain minimum investments for habit strength and compounding continuity, even during aggressive debt clearance seasons.

Balancing Debt Paydown and Investing Simultaneously

Maya allocated 70% of her surplus toward the 6% loan and 30% to the index fund. Her debt fell quickly, and consistent contributions captured market upswings, delivering psychological balance and measurable progress on both financial goals.

Mindset, Motivation, and Staying the Course

Celebrate micro-milestones: a paid-off card, a month of consistent investing, a new lower interest rate. Small celebrations nourish discipline, reminding you why debt freedom and investment growth will unlock choices you truly value.

Mindset, Motivation, and Staying the Course

Share your targets with a friend or our community, post monthly updates, and ask for feedback. Accountability transforms intentions into action. Comment your next debt payment milestone or investment goal, and subscribe to stay encouraged weekly.