Comparing Interest Rates: Debt Payments and Investment Returns

Chosen theme: Comparing Interest Rates: Debt Payments and Investment Returns. Welcome to a clear-eyed journey through the numbers that quietly steer your financial life—how interest rates shape every debt payment and every dollar you invest. Stay with us, ask questions in the comments, and subscribe for practical frameworks you can use today.

APR vs. APY: Why the Label Changes the Outcome

APR describes borrowing costs without compounding, while APY captures the effect of compounding on returns or interest you earn. When comparing debts to investments, align APR with APY thoughtfully, or you risk misreading the trade-off.

Compounding Frequency: Daily, Monthly, Annually—Small Differences, Big Dollars

A loan compounding daily grows interest faster than one compounding monthly, and the same truth applies to your savings. Even fractional differences shift payoff timelines and future values. Check your statements, then comment with your compounding schedule.

Real vs. Nominal: Inflation’s Hidden Hand

Nominal rates ignore inflation; real rates subtract it, revealing purchasing power. High inflation quietly reduces fixed-rate debt burdens yet also erodes investment gains. Consider inflation-linked bonds and realistic assumptions, and tell us how you factor inflation into plans.

Debt Payments Under Different Rates: From First Installment to Final Freedom

01

Fixed vs. Adjustable Loans: Stability or Risk?

Fixed rates lock costs and provide planning clarity; adjustable rates start lower but can reset painfully higher. Compare lifetime interest across plausible rate paths before choosing. Have you faced a surprise adjustment? Share what changed your strategy.

02

Refinance or Not? The Break-Even Point That Actually Matters

Calculate refinancing break-even by dividing total closing costs by monthly savings to estimate months to recover expenses. Then weigh remaining loan term, plans to move, and risk tolerance. If you refinanced recently, post your break-even and what tipped the decision.

03

Payoff Strategies: Avalanche vs. Snowball with Interest Rate Nuance

The avalanche targets highest rates first for mathematical efficiency; the snowball targets smallest balances for motivation. Blend both by attacking high-rate debts while keeping one quick win. Which approach kept you consistent when rates felt overwhelming?

Investing When Rates Move: Returns, Risk, and Time Horizons

Equities, Bonds, and Cash: What Usually Benefits When Rates Rise or Fall

When rates rise, bond prices typically fall, especially long-duration issues, while cash yields improve. Equities can adapt if earnings grow, yet valuation multiples may compress. How did your portfolio respond last cycle? Tell us what surprised you most.

Dividend Yield vs. Bond Yield: Apples, Oranges, and Total Return

A stock’s dividend yield is not guaranteed like a bond coupon, and price volatility differs. Focus on total return, duration risk, and business quality rather than chasing nominal yields. Share which metrics kept you disciplined during rate volatility.

Tax Drag and Account Choice: Let Compounding Work Untaxed

Tax-advantaged retirement accounts can shelter interest, dividends, and gains, letting compounding accelerate. Compare after-tax bond income to tax-efficient equity strategies. Which account types helped you keep more of your return as rates shifted upward?

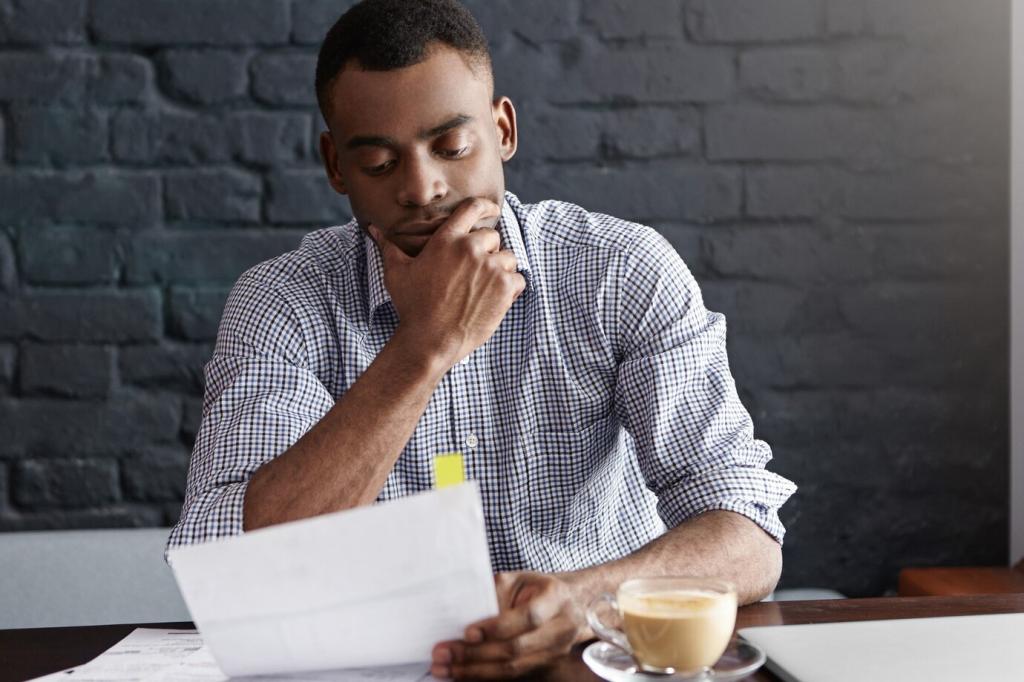

After-Tax Interest Cost vs. After-Tax Expected Return: A Fair Fight

Compare your effective, after-tax borrowing rate with realistic, after-tax expected returns adjusted for risk. If debt costs 6% after tax and you expect 5% after tax, payoff wins. If reversed, investing may prevail. Post your numbers for feedback.

Behavior Matters: Sleep-at-Night Rate of Return

A mathematically perfect plan fails if you abandon it. Some people thrive seeing balances vanish; others prefer portfolios growing. Choose the route you can follow during market drops or rate spikes, then share your personal ‘sleep-at-night’ threshold.

Liquidity First: Emergency Funds Beat Fancy Math

Before accelerating debt or investing aggressively, build a cash buffer. Liquidity prevents high-interest borrowing after surprises and protects long-term investments from forced selling. What emergency fund target keeps you calm—three months, six, or more? Tell us why.

Stories from the Kitchen Table: Real Comparisons, Real Trade-offs

Maya faced a 6.2% fixed student loan and expected 7% long-term equity returns. She split contributions, then redirected raises to the higher-rate debt. Five years later, she’s debt-free and still investing—share how you’d balance her trade-off.

List balances and rates, multiply each balance by its rate, sum, then divide by total debt. This weighted average clarifies your true borrowing cost. Post your number and we’ll suggest targeted payoff tactics.

Internal rate of return and net present value help compare payoff versus investing, but inputs matter. Be conservative with expected returns and discount rates. Share your model assumptions and ask for a sanity check from readers.

Model higher payment shocks for adjustable loans and lower bond prices from duration effects. Then test employment, inflation, and market dips simultaneously. What scenario broke your plan—and how did you redesign it to be resilient?

Gather Your Rates and Terms: Build a One-Page Snapshot Tonight

List every debt with balance, rate type, compounding, and payment. List investments with expected return, risk, and tax treatment. This single page fuels confident comparisons. Share your template request and we’ll send a checklist.

Run the Comparison, Then Automate: Make the Decision Stick

Compare after-tax debt costs against after-tax expected returns, then pick a rule: payoff threshold or invest threshold. Automate transfers and extra payments so emotions don’t derail progress. Comment with your automation plan for accountability.

Share, Ask, Subscribe: Join the Conversation on Rates and Returns

Post your rate questions, unusual loan terms, or investing dilemmas. We feature thoughtful reader cases and update tools as conditions change. Subscribe now to receive scenario walkthroughs when the interest-rate landscape shifts again.